Hero image

Intro Copy

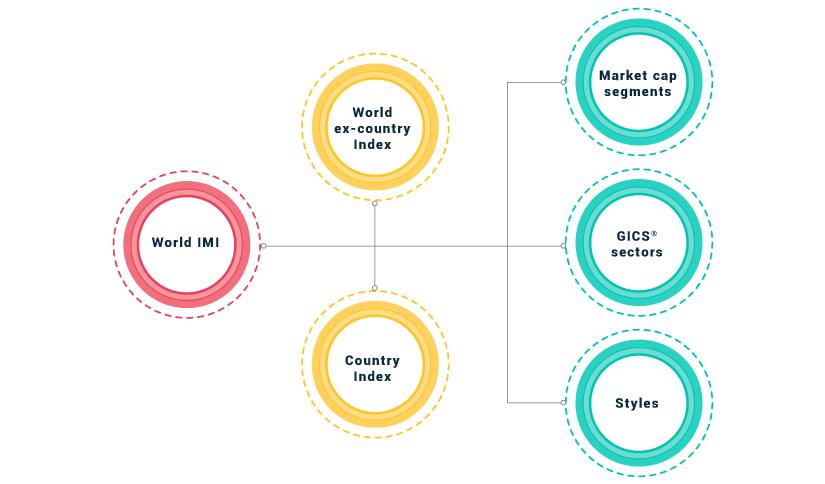

MSCI Developed Markets Indexes

MSCI Developed Markets Indexes are built using MSCI’s Global Investable Market Index (GIMI) methodology, which is designed to take into account variations reflecting conditions across regions, market cap segments, sectors and styles. The indexes are available in various size – large, mid, small, and micro caps or a combination of these. Our style indexes are designed to represent the performance of securities exhibiting the value/growth characteristics. Sectors indexes comprise global, regional and country sector, industry group and industry indexes using the Global Industry Classification Standard (GICS®). All indexes are available in Price, Net and Total return variants.

| Developed Markets | |||

|---|---|---|---|

| Americas | Europe & Middle East | Pacific | |

| Canada | Austria | Italy | Australia |

| USA | Belgium | Netherlands | Hong Kong |

| Denmark | Norway | Japan | |

| Finland | Portugal | New Zealand | |

| France | Spain | Singapore | |

| Germany | Sweden | ||

| Ireland | Switzerland | ||

| Israel | United Kingdom | ||

REGIONAL INDEXES

Regional Indexes

MSCI World Index: The MSCI World Index is a broad global equity index that represents large and mid-cap equity performance across all 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country.

Performance | Factsheet (PDF, 180 KB) (opens in a new tab)

MSCI EAFE Index: The MSCI EAFE Index is designed to represent the performance of large and mid-cap securities across 21 developed markets, including countries in Europe, Australasia and the Far East, excluding the U.S. and Canada. It covers approximately 85% of the free float-adjusted market capitalization in each country.

Performance | Factsheet (PDF, 180 KB) (opens in a new tab) | Brochure (PDF, 1.2 MB) (opens in a new tab)

MSCI Europe Index: The MSCI Europe Index represents the performance of large and mid-cap equities across 15 developed countries in Europe. It covers approximately 85% of the free float-adjusted market capitalization in each country.

Performance | Factsheet (PDF, 180 KB) (opens in a new tab) | Brochure (PDF, 558 KB) (opens in a new tab)

Country Indexes

Country Indexes

MSCI USA: The MSCI USA Index represents 63% of the MSCI World Index1. It is designed to measure the performance of the large and mid-cap segments and aims to represent ~85% of the US market.

Performance | Factsheet (PDF, 180 KB) (opens in a new tab) | Brochure (PDF, 424 KB) (opens in a new tab)

MSCI Japan: The MSCI Japan Index represents 8% of the MSCI World Index1. It is designed to measure the performance of the large and mid-cap segments and aims to represent ~85% of the Japanese market.

Performance | Factsheet (PDF, 176 KB) (opens in a new tab)

MSCI United Kingdom: The MSCI United Kingdom Index represents 5% of the MSCI World Index1. It is designed to measure the performance of the large and mid-cap segments and aims to represent ~85% of the United Kingdom market.

Performance | Factsheet (PDF, 176 KB) (opens in a new tab)

MSCI Singapore: The MSCI Singapore Free Index is designed to measure the performance of the large and mid-cap segments of the Singapore market and covers approximately 85% of the free float-adjusted market capitalization of the Singapore equity universe.

Factsheet (PDF, 175 KB) (opens in a new tab) | Brochure (PDF, 1.27 MB) (opens in a new tab)

MSCI World Index - Country Allocation*

MSCI World Index - Country Allocation*

*MSCI Data as of June 30, 2020

Applications

Applications

Building Block Approach

Our Building Block Approach

MSCI World Indexes offer a building block approach with a rules-based, consistent and transparent methodology. Using MSCI World as a framework to build global developed market equity portfolios can help to avoid unintended bets and risks. Robust foundation allows investors to measure exposure to all sources of equity returns using a single global framework.

MSCI World Index Daily Performance

Index Preview

Is Europe More Than The Sum Of Its Parts?

Is Europe More Than The Sum Of Its Parts?

Investors have a choice between investing in European stocks regionally or through local-country index-based portfolios. What are the pros and cons?

Index Solutions

Index Solutions

We have remained a market leader by expanding and enhancing our index offering to reflect the evolving and complex needs of the institutional investment community – with groundbreaking new products, innovative research, high quality data and dedicated client support.

Market Cap Indexes

Market Cap Indexes

Our market cap weighted indexes are among the most respected and widely used benchmarks in the financial industry. Collectively, they provide detailed equity market coverage for more than 80 countries across developed, emerging and frontier markets, representing 99% of these investable opportunity sets.