面包屑导航

Diversified multi-factor hero image

MSCI DIVERSIFIED MULTIPLE-FACTOR INDEXES

MSCI diversified multiple-factor indexes

Trade instinct for insight

Factors are key drivers of risk and return and through advancements in data and technology can be accessed through Factor Indexes. Factor indexes offer investors a basis to seek the return premium historically provided by certain factor-based strategies.

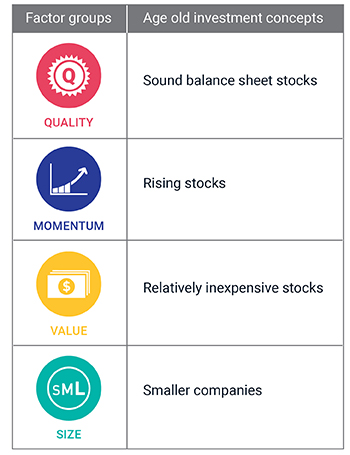

MSCI Diversified Multiple-Factor Indexes select stocks based on intuitive, well known investment concepts.

MSCI Diversified Multiple-Factor Indexes are broadly diversified, systematic and replicable. These innovative indexes are designed to maximize exposure to four factors – Value, Momentum, Quality and Low Size – while maintaining a risk profile similar to that of the underlying parent index.

DMF Video

To understand how our experts constructed the index, understand our methodology and factor optimization and see how the index is designed to provide diversification benefits over single-factor indexes:

Maximizing Factor Exposure While Controlling Volatility

Multi-factor indexes are designed for use by investors seeking diversified exposure to factors that have historically generated superior returns without diluting the strength of their exposure to their targeted factors and without structurally changing the risk profile of their portfolios.

The MSCI Diversified Multiple-Factor Indexes methodology includes a systematic risk control designed to diversify the risk characteristics common in single factors by targeting high, persistent exposure to the target factors with market-like volatility over time.

Available indexes

A sampling of the Diversified Multiple-Factor Indexes, which are based on their respective MSCI parent indexes, are currently available:

- MSCI ACWI Diversified Multiple-Factor Indexes

- MSCI Emerging Markets Diversified Multiple-Factor Indexes

- MSCI USA Diversified Multiple-Factor Indexes

- MSCI USA Small Cap Diversified Multiple-Factor Indexes

- MSCI World ex USA Diversified Multiple-Factor Indexes

- MSCI World ex USA Small Cap Diversified Multiple-Factor Indexes

- MSCI World Diversified Multiple-Factor Indexes

- MSCI Europe Diversified Multiple-Factor Indexes

- MSCI AC Asia Pacific Diversified Multiple-Factor Index

Applications

MSCI Diversified Multiple Factor Indexes can be used to support:

- Investment allocation: Adding a factor return component to portfolio strategies through structured products and other index-linked investment vehicles, such as ETFs and ETNs.

- Performance measurement and attribution: Benchmarking factor-driven performance of specific investment strategies, as well as defining factor-based stock universes.

- Research: A trusted source of data for sell-side research.

Awards 2021

Awards 2021

Equity Factor Index Provider of the Year at Professional Pensions Investment Awards 2021

Research insight

Research insight

Multi-factor index fund allocations are increasingly becoming the preferred approach to factor investing.

MSCI Japan Equity Factor Models

MSCI Japan Equity Factor Models

Leverage factors like sustainability, crowding and machine learning for building more resilient portfolios as market conditions change.

Interested in our Insights on Factors?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning factor research, industry events, and latest products.