面包屑导航

Factor ESG indexes hero image

MSCI factor ESG target indexes

MSCI factor ESG target indexes

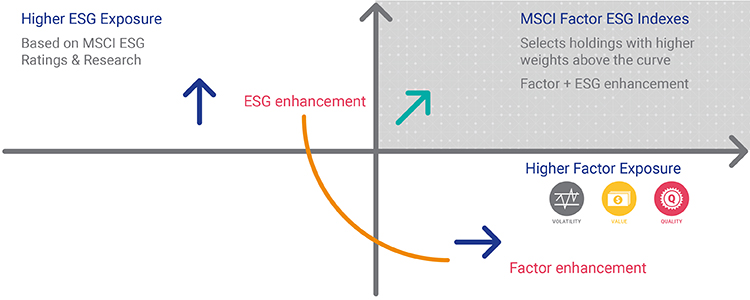

MSCI Factor ESG Target Indexes are designed to represent the performance of a strategy that seeks systematic integration of ESG (Environmental, Social and Governance) into Factor Investing. They help provide a set of Factor Indexes that aim to be more “ESG-aware”.

With more investors seeking to integrate ESG into their Factor allocation strategy, MSCI Factor ESG Target Indexes are designed to combine Factor and ESG exposures simultaneously in a transparent and efficient manner. The indexes are constructed based on parent MSCI indexes, which are used as benchmarks by many institutions; they are designed to allow for seamless allocation along with liquidity and replicability.

The methodology used in MSCI Factor ESG Target Indexes aims at maximizing the exposure to the target Factor along with 20% ESG score improvement of the Factor index relative to its parent market-cap weighted index1. This approach is designed to be scalable across regions and countries, and across both single and multiple-factor indexes.

For further information, download our factsheet.

1 “Factor Investing and ESG integration” Melas et al, MSCI Research, November 2016

A leader in Factor Indexes and ESG Rating and Research, MSCI continues to lead innovation by combining the merits of both to bring next generation Factor ESG Target Indexes to market.

INTEGRATING FACTORS AND ESG

MSCI’s approach of optimizing Factor and ESG exposures places higher weighting on the stocks above the curve. This approach is highly customizable to achieve intended dual Factor and ESG enhancement.

Performance, factsheets and methodology

MSCI Minimum Volatility ESG Target Indexes

MSCI World Minimum Volatility ESG Target Index

MSCI Europe Minimum Volatility ESG Target Index

MSCI USA Minimum Volatility ESG Target Index

MSCI Japan Minimum Volatility ESG Target Index

MSCI Quality ESG Target Indexes

MSCI World Quality ESG Target Index

MSCI Europe Quality ESG Target Index

MSCI USA Quality ESG Target Index

MSCI Japan Quality ESG Target Index

MSCI Value ESG Target Indexes

MSCI World Value ESG Target Index

MSCI Europe Value ESG Target Index

MSCI USA Value ESG Target Index

MSCI Japan Value ESG Target Index

MSCI Multiple-Factor ESG Target Indexes

MSCI World Multiple-Factor ESG Target Index

MSCI Europe Multiple-Factor ESG Target Index

MSCI USA Multiple-Factor ESG Target Index

MSCI Japan Multiple-Factor ESG Target Index

Applications

Our Factor ESG Target Indexes can be used to support:

- Asset allocation: Adding a factor return component to portfolio strategies.

- Performance measurement and attribution: Benchmarks factor-driven performance of specific investment strategies, as well as defining factor-based stock universes.

- Research: A trusted source of data for sell-side research.

- Investment product development: May be licensed for use as the basis for structured products and other index-linked investment vehicles, such as ETFs and ETNs.

Additional insights and research

ESG

How to Integrate ESG without Sacrificing Diversification

Keep it broad: An approach to ESG strategic tilting

Factor Investing

Integrating ESG Criteria into Factor Index Construction

The MSCI Factor ESG Target Indexes paper

Integrating ESG into Factor Portfolios

Can Alpha be Captured by Risk Premia?

Harvesting Risk Premia for Large Scale Portfolios

Harvesting Risk Premia with Strategy Indexes

Portfolio of Risk Premia: a new approach to diversification

Applications of Systematic Indexes in the Investment Process

Factor Indexes in Perspective: Insights from 40 Years of Data Part I

Factor Indexes in Perspective: Insights from 40 Years of Data Part II

Navigate financial traffic

Navigate financial traffic

MSCI Crowding models help investors assess their exposure to crowdedness—of individual securities, factors and hedge fund holdings—gain insight into how the rest of the market is positioned, and navigate crowded markets by providing high quality, timely crowding information to make the best informed decisions to achieve their investment objectives.

MSCI ESG universal indexes

MSCI ESG universal indexes

The new MSCI ESG universal indexes are a modern way of indexing, and are designed to address the needs of asset owners, who may look to enhance their exposure to ESG while maintaining a broad and diversified universe to invest in.

MSCI ESG Enhanced Focus Indexes

MSCI ESG Enhanced Focus Indexes

Customized indexes combining ESG with low carbon investing while maintaining a low tracking error relative to the underlying index. Download the product insight report