TCFD hero banner

What is the TCFD?

What is the TCFD?

To support the goals of the Paris climate agreement, the Financial Stability Board (FSB) created the Task Force on Climate-related Financial Disclosure (TCFD) in 2015. This voluntary disclosure platform was designed to “provide a framework for companies and other organizations to develop more effective climate-related financial disclosures through their existing reporting processes” and support “more informed investment, credit [or lending], and insurance underwriting decisions”.

In February 2019, the UN Principles of Responsible Investment (PRI) indicated its climate risk strategy and governance indicators, which are aligned with the TCFD guidelines, would become mandatory for PRI signatories from 2020 but voluntary to disclose publicly

TCFD Based Reporting: A practical guide for Institutional investors

MSCI’s TCFD based reporting brief is aimed at institutional investors intending to report on their climate transition risk management processes according to the TCFD recommendations. This guide steps through the core elements of the TCFD framework through an institutional investor lens, supported with examples.

Four sections of the TCFD provide guidance

Integrating climate change solutions into your investment process

Integrating climate change solutions into your investment process

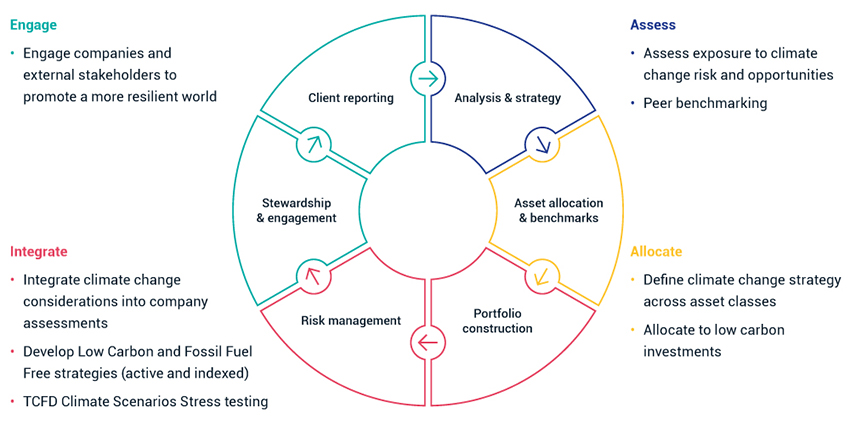

MSCI ESG Climate Change Solutions give you access to a wide range of tools and data designed to enable you to integrate climate change risks and opportunities along your entire investment management value chain and disclose according to the TCFD guidelines.

Further reading

- Blog: As TCFD Comes of Age, Regulators Take a Varied Approach

- Recorded Webinar: TCFD-based climate reporting and scenario analysis for institutional investors

- Blog: Corporate disclosure in a TCFD World

- Recorder Webinar: Understanding Portfolio-Level Climate Risk and Opportunities to Support TCFD Requirements

- Recorded Webinar: Building Climate Resilient Portfolios – Americas/EMEA session

- Recorded Webinar: Building Climate Resilient Portfolios – APAC session

- Research paper: Alignment to Climate Regulatory Scenarios: A Case Study of Australian Companies

- Blog: A road map for resilient carbon-transition portfolios

- Research paper: Climate change and climate risk: An index perspective

related content

Related Content

MSCI Climate Indexes

MSCI offers a range of indexes for investors who seek to incorporate climate risks and opportunities into their investment process.

Learn MoreMSCI ESG TCFD Seminars

Check out the dates for our TCFD roadshow through Europe and Asia this October and November.

Explore MoreMSCI ESG Enhanced Focus Indexes

The MSCI ESG Enhanced Focus Indexes aim to maximize their ESG profile and reduce carbon exposure while maintaining risk and return characteristics similar to the underlying parent index.

Learn More