Breadcrumb

Finding value hero image

Finding a New Path to Value Exposure

Finding a New Path to Value Exposure

The MSCI Enhanced Value Index

First described nearly 80 years ago, value investing has continually evolved. Investors have used various approaches to identify their exposure to the value factor in the equity markets. A factor, by definition, is any characteristic that helps explain the risk and return of a group of securities. But how do we capture and define “value” in today’s markets?

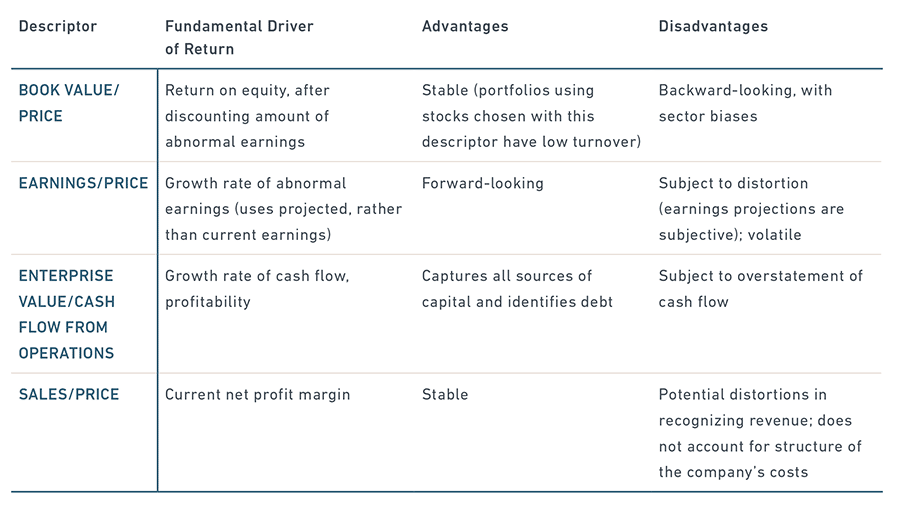

Four widely used metrics, or descriptors, are used to track the value factor: book value, earnings, enterprise value and sales.

Table of Common Value Descriptors

Each of these descriptors has its own set of advantages and pitfalls, particularly in regard to risk/return profiles, investability and tracking error. MSCI has created a common definition of value by using multiple descriptors in our Enhanced Value Index. This provides a better path to value by combining the advantages of each individual descriptor while mitigating its disadvantages.

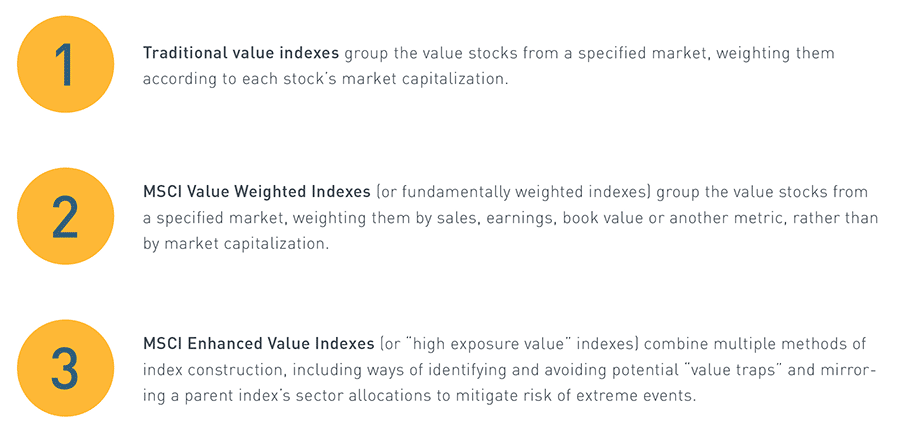

Index Approaches to Value Investing

MSCI’s Enhanced Value Indexes provide the purest approach to a factor that is a perennial favorite among investors. In comparison, generic traditional value indexes and the MSCI Value Weighted Indexes offer high capacity and liquidity as well as lower tracking error.

In an upcoming series of white papers, we will explore more factors that identify specific risk exposure with the potential for an accompanying premium:

- Low size

- Low volatility

- High yield

- Quality

- Momentum

Blog

Blog

Despite agreement on the principles of value investing, the investment community uses a number of different metrics to describe the value factor.

Research Spotlight

Research Spotlight

Investors today use various approaches to identify and compare the exposure of stocks with “value” characteristics that help explain risk and return.

Research insight

Research insight

Finding Value: Understanding Factor Investing

Authors - Anil Rao, Raman Subramanian, Abhishek Gupta, Altaf Kassam