Ukraine Conflict and Fed Action

Ukraine Conflict and Fed Action

As trading stopped following Russia’s invasion of Ukraine, we looked to the markets on two key questions:

- How could the invasion impact Federal Reserve rate hikes to address inflation?

- How might Fed action change if oil prices rise significantly?

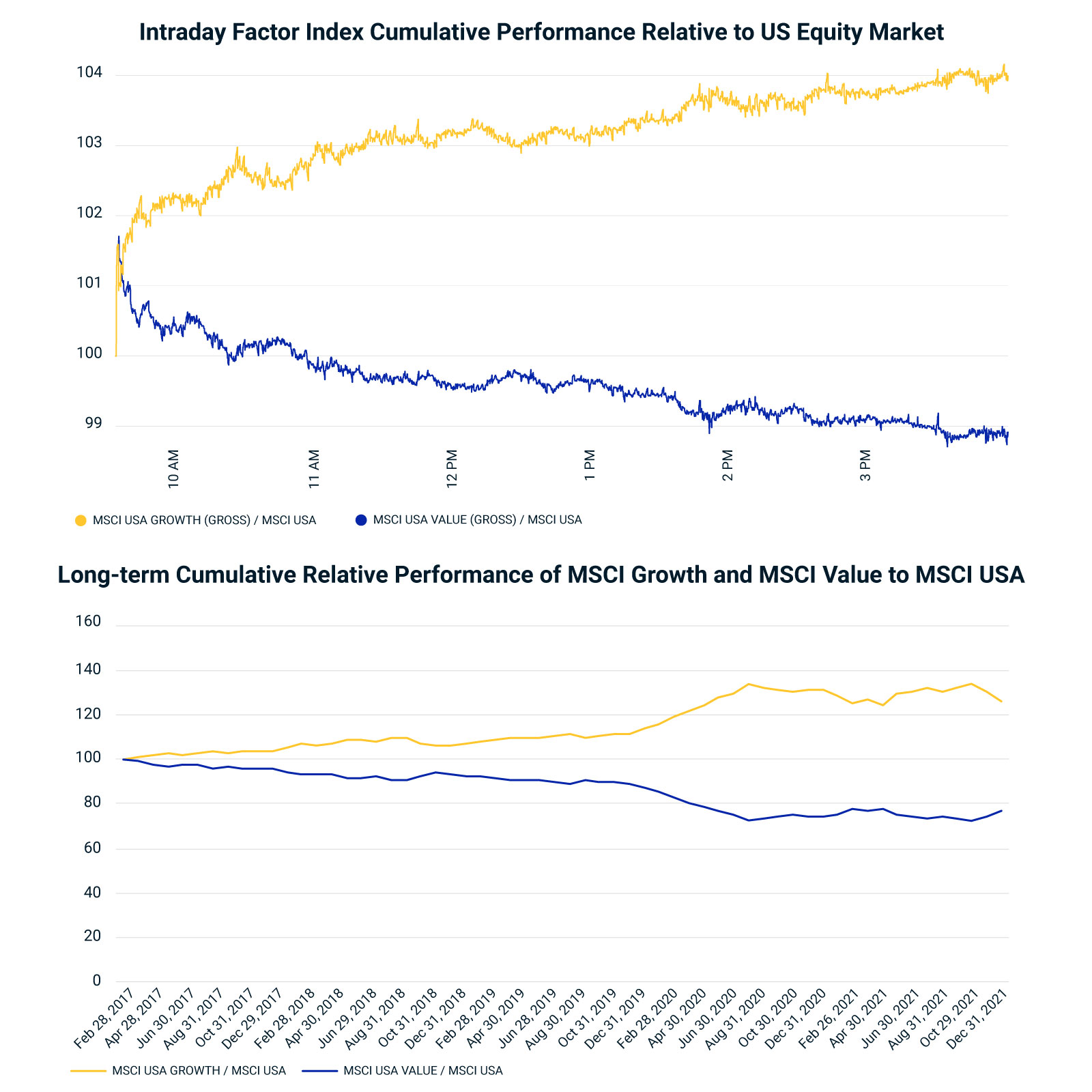

As of the closing bell on Feb. 24, the market appeared to expect a dovish approach from the Fed. This assessment is based on our analysis of the intraday performance of the MSCI USA Value and MSCI USA Growth Indexes. After a few tough weeks for growth earlier in the month, the first chart below suggests that growth seems to have gotten a reprieve, as it rallied versus value.

As Fed governors and others charged with keeping watch on the global economy look for clues on how to proceed, we’ll continue to monitor market reaction.

Factor performance provides insight into investor sentiment

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore MoreSocial Sharing

Ukraine Conflict and Fed Action related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreCompanies Most Exposed to Ukraine

As investors work to evaluate the effects of a growing list of economic sanctions against Russia, and the devastating impacts inside Ukraine, it can be difficult to keep perspective.

Read More