Extended Viewer

CSRD: Raising the Burden or Raising the Bar?

With the EU Commission’s launch of the Omnibus Simplification Package, intended to significantly streamline the Corporate Sustainability Reporting Directive (CSRD), debate has reignited over the costs and benefits of the CSRD.1

Under the CSRD, companies are required to use the European Sustainability Reporting Standards (ESRS) for their sustainability reporting. Although the ESRS contains roughly 1,200 data points, companies must conduct a double-materiality assessment to determine which data points are relevant for their disclosures.2

An investor-critical lens slims number of material data points

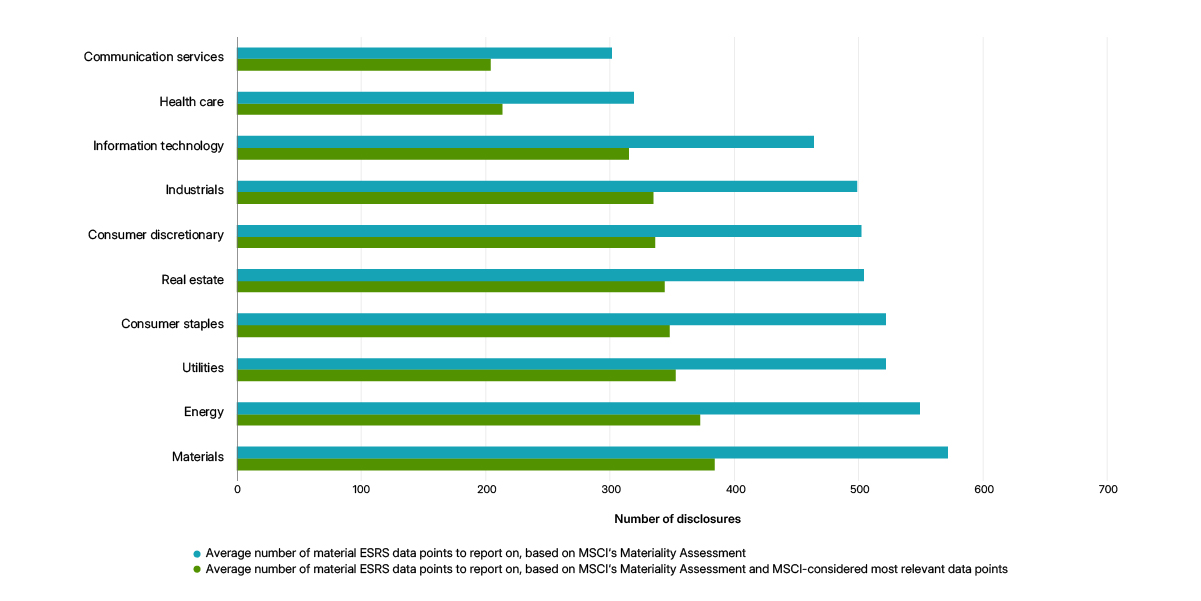

We conducted our own materiality assessment across 163 Global Industry Classification Standard (GICS®)3 sub-industries and found that, on average, a company may recognize fewer than 500 data points as being material for their business. Applying an investor-focused lens on these results, this number could possibly drop to 300 data points.

We used the following rationale to determine which of the ESRS data points were critical from an investor’s perspective:

- Aligned with other existing reporting frameworks, globally applicable and comparable

- Could potentially be used for investment decisions as well as for regulatory purposes

- Widely available in corporate disclosure or where reporting can reasonably be deemed feasible

Sector matters to materiality

The estimated number of material ESRS data points varies by sector. Unsurprisingly, capital-heavy industries have the largest estimated ESRS reporting burden due to their significant environmental and social intensities. Other sectors, such as communication services, may find significantly fewer data points material.

Our findings indicate that simplifying the current CSRD reporting framework may improve usability and interoperability, while maintaining the most investor-critical, comparable and actionable disclosures.

Estimated average number of material ESRS data points per sector

1 Yusuf Khan, “Europe Waters Down Flagship Climate-Accounting Policy,” Wall Street Journal, Feb. 26, 2025.

2 European Union, “Directive (EU) 2022/2464 of the European Parliament and of the Council of 14 December 2022 amending Regulation (EU) No 537/2014, Directive 2004/109/EC, Directive 2006/43/EC and Directive 2013/34/EU, as regards corporate sustainability reporting,” Official Journal of the European Union L 322, Dec. 16, 2022.

3 GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

Related content

EU's Omnibus Proposal: What You Need to Know

In February 2025, the EU Commission proposed the first Omnibus Package of sustainability rules, with the aim of simplifying and reducing EU sustainability reporting requirements. But did it work? Has the outcome been "good" or "bad"? And what are these new rules set to do to the future of sustainable finance in the EU?

Listen to the episodeSustainable-Finance Regulation — a Look Ahead for 2025

2025 could mark a turning point for sustainable finance, with the EU’s CSRD and global ISSB standards driving transparency. Financial institutions will need to navigate evolving frameworks, balancing compliance challenges with sustainability opportunities.

Read the blog postWhat is impact materiality?

What is impact materiality, you ask? And how is it different from financial materiality? A fine and important question, listener! In this episode we take you through all the details you need to parse through the most important sustainability-jargon out there. Including, an explanation of the EU's Corporate Sustainability Reporting Directive, or the CSRD, which has its first required reporting cycle due next year.

Listen to the episode