Extended Viewer

Drawdowns Can Have a Silver Lining for Your Taxes

The recent tariff turmoil that has shaken portfolios has also created opportunities for wealth managers and investors to pursue tax-efficient rebalancing through loss harvesting. We found that a systematic, event-driven approach to tax-loss harvesting, compared to a periodic-only approach, could have improved a hypothetical U.S. equity portfolio’s after-tax performance by 2.6 percentage points over the last six years — that’s 40 basis points (bps) annually.

We simulated and compared two loss-harvesting strategies

Our hypothetical U.S. investor held a U.S. equity portfolio that was initially funded with cash. It was allocated to approximately 250 stocks selected from the roughly 600 constituents of the MSCI USA Index. The initial portfolio had minimal initial tracking error (TE) relative to the index.1

The loss-harvesting approaches we compared were:

- Periodic only — semiannual portfolio rebalances, in June and December, that align with MSCI’s semiannual index reviews.

- Periodic and opportunistic — semiannual rebalances, as in the periodic-only strategy, and rebalances following drawdowns of 15% or more in the MSCI USA Index that occurred after the previous rebalancing date.

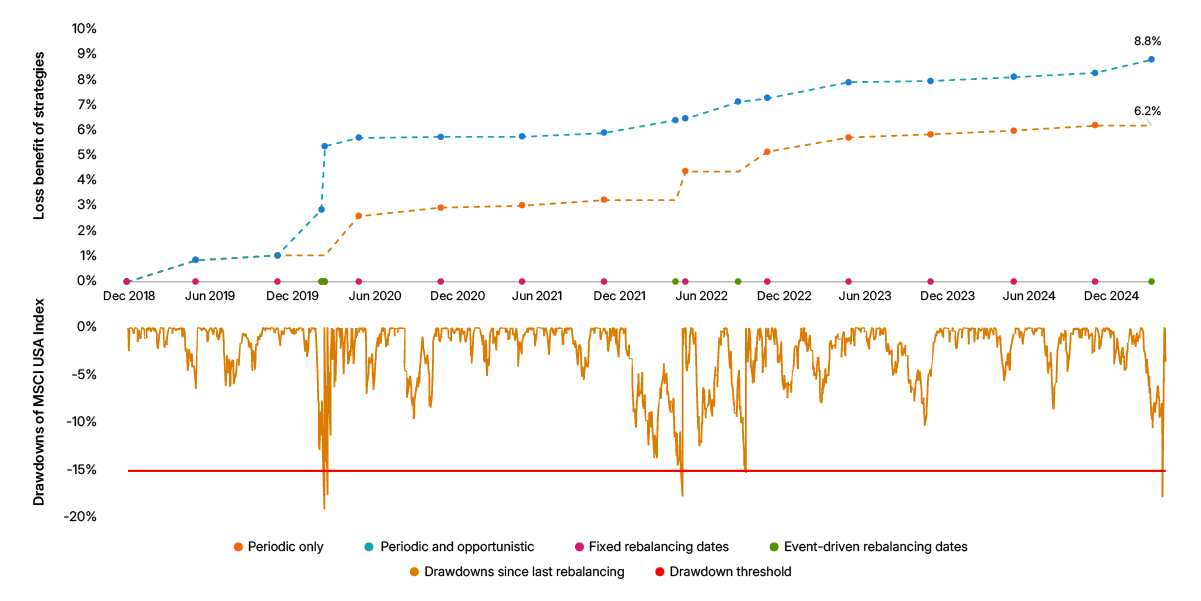

Since January 2019, the MSCI USA Index had several drawdowns exceeding 15% that triggered a rebalancing under the periodic-and-opportunistic approach.2 Two occurred during the COVID-19 pandemic in March 2020. The others were declines in May and September 2022 amid fears of rising inflation, and the most recent drawdown was in response to the 2025 tariff turmoil. We conducted tax-loss optimizations at these five times, in addition to the fixed rebalance dates in June and December of each year.

We found opportunity in the drawdowns

By exploiting these market drawdowns, the periodic-and-opportunistic strategy produced a tax benefit of 8.8% compared to 6.2% for the periodic-only strategy. The former increased the portfolio’s after-tax return by 40 bps annually since January 2019.3

So, whereas drawdowns can negatively impact portfolio values, they can also have a silver lining, presenting opportunities for more effective tax-loss harvesting.

The author thanks Thomas Verbraken for his contributions to this quick take.

Simulated opportunistic rebalancing led to higher after-tax performance

1 Over the full period, the average TE is 60 bps for the periodic-only strategy and 150 bps for the strategy that combines periodic and opportunistic loss harvesting.

2 In the periodic-and-opportunistic approach, when the 15% drawdown threshold is breached, we run a tax-loss-harvesting optimization and reset the peak from which the drawdown is calculated to that day’s level.

3 After-tax performance was calculated by adjusting pre-tax performance to account for both taxes and the benefits of realized losses. In line with the United States Investment Performance Committee (USIPC) After-Tax Performance Standards promulgated by CFA Institute, taxes have a negative effect on performance, while realized losses can have a positive effect. More frequent rebalancing by taking advantage of drawdowns increased the average annual turnover from 14% to 23%.

Related content

How Tariffs Could Impact Equity Markets: Building Scenarios

Tariff risks are at center stage for investors. To help manage the uncertainty, this blog post shows how revenue-exposure data and a scenario-analysis framework enable equity investors to translate targeted industry assumptions into potential portfolio-level impacts.

Read the blogTotal Portfolio Allocation for Modern Wealth

Traditional asset allocation theories often overlook private assets. We provide a practical blueprint for total portfolio allocation management, focused on a deeper understanding of market correlations to better manage concentration risk and uncertainty in expected returns.

Access the paper