Extended Viewer

Mapped or Missed? Navigating Tariff Uncertainty

In an environment shaped by unpredictable trade policies, supply-chain traceability may represent a key risk-management tool. By enabling companies to identify the origin of goods, traceability helps pinpoint exposure to high-duty regions, allowing for more informed decision-making. Businesses that have a clear view of their supply chains are better positioned to plan for higher costs, navigate trade barriers and pivot to alternative suppliers where needed.

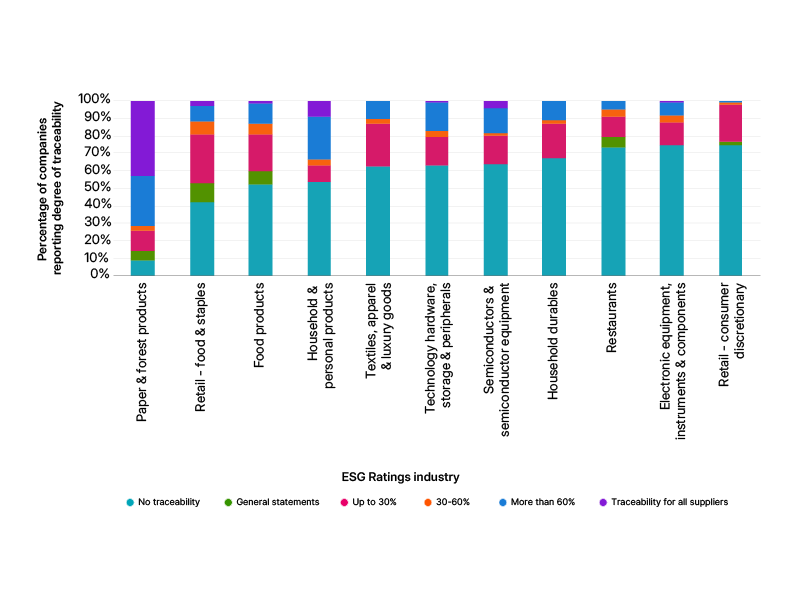

Our analysis reveals that many industries depend on complex, multi-tiered supply chains, yet levels of raw-materials traceability vary significantly. Notably, retail — consumer discretionary, electronic equipment, instruments and components and restaurants — reported the lowest levels of traceability.1 This presents a risk for retailers, especially within consumer discretionary, who source a wide range of products — from apparel and accessories to books and electronics — across numerous global supply chains.

Investor implications

For investors, industries with low supply-chain traceability, particularly consumer discretionary and electronics, may face heightened vulnerability to tariff-related disruptions, indicating a potential increase in risk exposure. Conversely, sectors like paper and forest products with robust traceability may offer investors greater predictability and resilience amid ongoing trade uncertainties.

Supply-chain traceability

1 Sectors refer to the Global Industry Classification Standard (GICS®) sectors. GICS is the global industry classification standard jointly developed by MSCI and S&P Global Market Intelligence.

Social Risks and Opportunities for Corporates: Long-Term Performance in Global Equity Markets

What goes into an analysis of financially material social risks and opportunities? And what does it mean for a company’s market performance? Our analysis found that scoring on social-risk themes was a key indicator of performance.

Explore moreSustainable Investing: MSCI ESG Ratings

Assess companies on their financially relevant sustainability risks and opportunities

Read more