Extended Viewer

Say-on-Climate Update: Navigating the Winds of Change

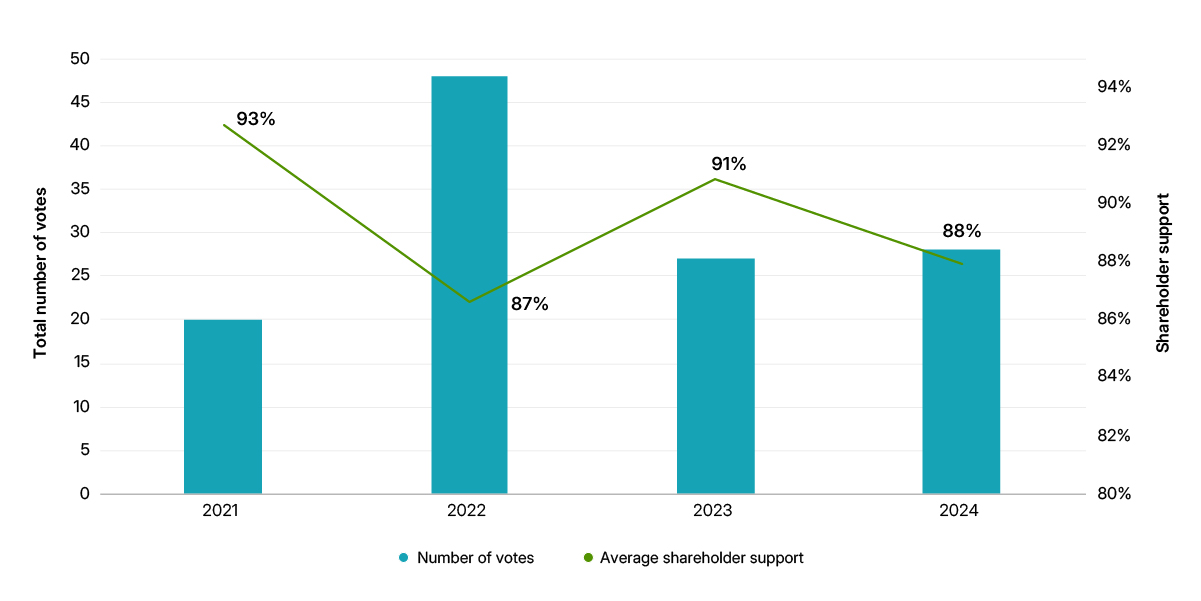

Since 2021, multiple high-profile companies have brought their climate-transition plans to an advisory, management-sponsored shareholder vote, opening a new engagement channel on climate issues. After a notable decline in the number of votes in 2023, those numbers stabilized in 2024. A deeper look at those numbers can help investors determine which way the winds may be blowing.

Stable number of votes, regional concentration

We identified 28 say-on-climate votes in the 2024 proxy season, one more than in the previous year. While well below the record set in the 2022 season (48), the number of companies willing to offer this avenue for shareholder engagement appears to have stabilized. In line with previous years, a large majority (79%) of 2024 votes took place at European companies, indicating a consistent regional concentration.

While shareholder support generally remained high, average support for these resolutions decreased, from 91% in 2023 to 88% in 2024. This suggests greater willingness on the part of some investors to formally oppose a company’s approach to the climate transition. Shareholders also voted down Woodside Energy Group’s climate-transition action plan at the Australian energy company’s 2024 annual general meeting. This was the first-ever say-on-climate defeat in our analysis.

Average shareholder support declined in 2024 vs. 2023

Related content

Is Say-on-Climate Losing Steam?

As proxy season nears, investors looking at how companies in their portfolios are working toward establishing and meeting climate goals may find it useful to note trends around shareholder say-on-climate proposals.

Read the quick takeWho’s the Climate Expert on Board?

What’s the state of climate expertise on the boards of the companies in your portfolio? We provide a regional analysis and offer a framework to help investors make their own assessments.

Read the blog postCorporate Governance: Market Matters

Good governance is foundational to effective capital markets, promoting accountability, transparency and sound decision-making aligned with investor interests. But how do those potential benefits translate into market performance?

Read more