Bond-Market Contagion Signals from the Russia-Ukraine War

Bond-Market Contagion Signals from the Russia-Ukraine War

Following up on our earlier research on contagion indicators, we looked at how the liquidity of corporate bonds from Eastern European countries (the Czech Republic, Hungary, Poland, Slovakia and the Baltic states) has changed since the start of the Russia-Ukraine war.

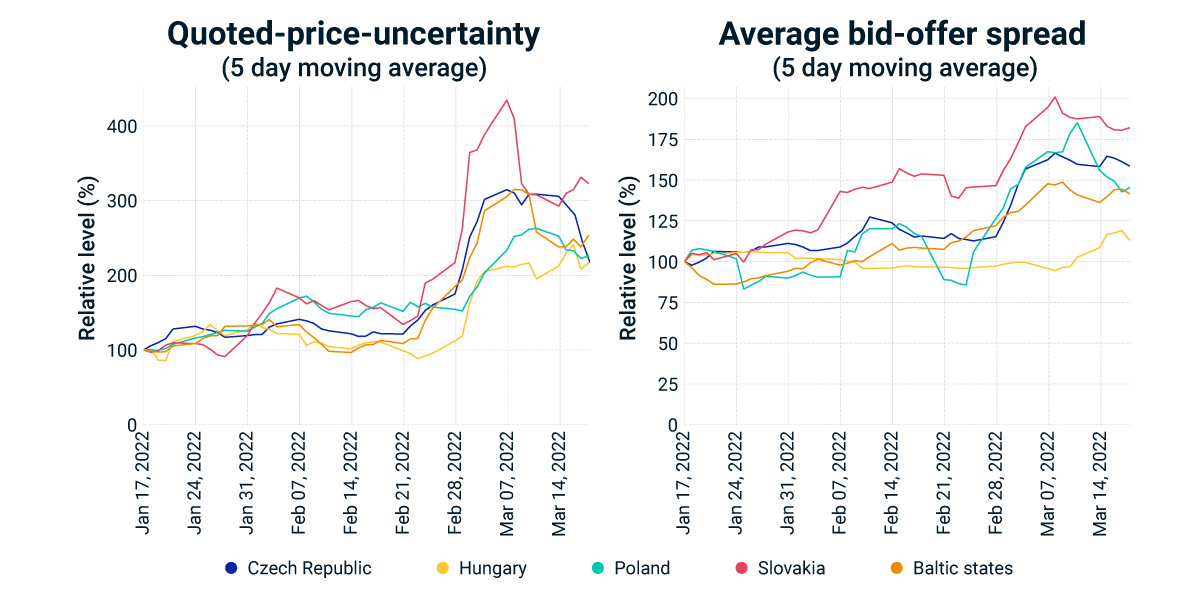

We found that broker-dealers had a difficult time pricing these assets, as indicated by substantially increased quoted-price uncertainty. Bid-offer spreads in these countries have also increased — some by up to 100% — indicating that broker-dealers wanted to be compensated for holding these bonds in their inventory.

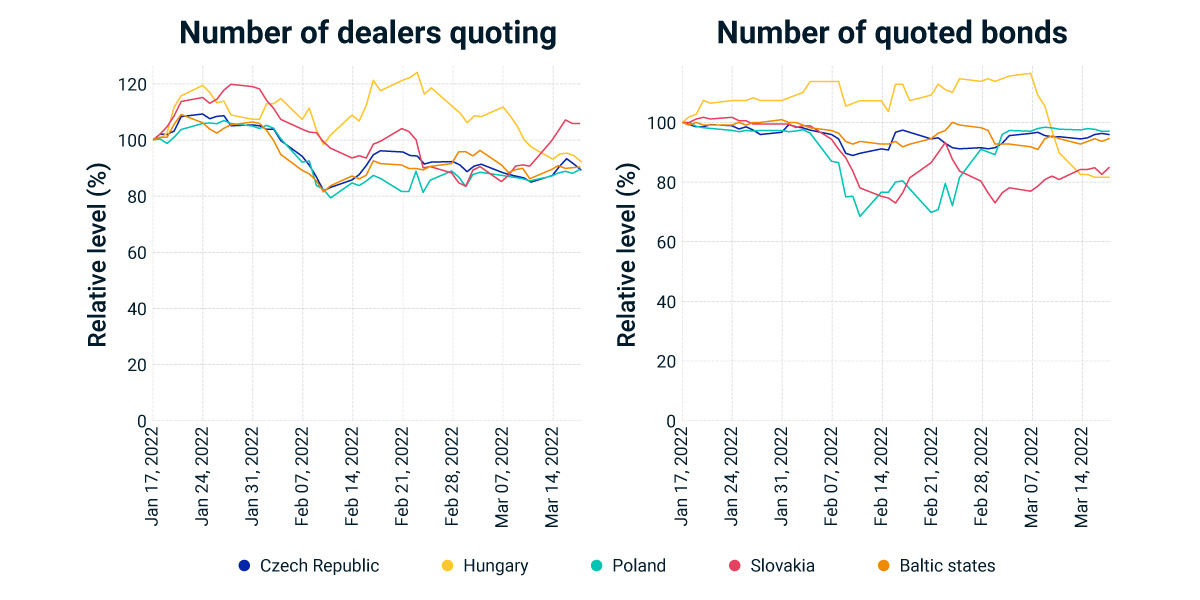

We note, however, that liquidity has not dried up completely. Neither the number of bonds quoted nor the average number of dealers quoting these bonds has decreased significantly.

Related Content

Research and Insights

Our investing insights explore the topics that matter most, whether on climate and ESG, current market trends or global investing and risk management across asset classes.

Explore MoreSocial Sharing

Bond-Market Contagion Signals from the Russia-Ukraine War related content

Related Content

Russia - Ukraine War

MSCI is closely monitoring the Russian invasion of Ukraine and how it might affect our colleagues, clients, and business partners. We will continue to assess the implications.

Explore MoreRussia Avoided Default, At Least For Now

Despite uncertainty around whether sanctions will bar creditors from receiving payments, Russia paid USD 117 million of interest due for two Russian hard-currency bonds, on March 16.

Learn MoreMarkets Brace for More Rate Hikes, as War Fans Inflation Fears

Russia’s invasion of Ukraine has added to an already-long list of concerns for global investors, which have led central banks around the world to reassess monetary policy, as they seek to balance economic growth and inflation.

Read More