Counterparty credit risk and the initial-margin big bang

Blog post

January 22, 2020

- A forthcoming regulatory framework will require derivatives users to collect and post initial margin on their over-the-counter derivatives portfolios.

- Investors face the challenge of estimating future dynamics of their mandatory initial margin as part of their assessment of counterparty credit risk.

- Our analysis assessed the historical accuracy of different types of models in estimating future initial margin. We found that model selection may have a significant impact on the calculation of credit exposure and value adjustment.

The challenge of estimating future initial margin

The International Swaps and Derivatives Association provides a widely accepted calculation method for today's (spot) initial margin.5 However, the assessment of future exposure, a key measure of CCR, requires the estimation of future initial margin. A brute-force simulation, explicitly modeling the future initial margin, is computationally very demanding. We assess a couple of alternative methods of varying degrees of sophistication:6

- Simulated initial margin: The future initial margin is estimated using MSCI's value-at-risk-based (VaR) methodology.7

- Notional initial margin: The future initial margin is the current initial margin multiplied by the ratio of the notional amount of the non-matured positions at the future horizon and the current total notional amount.

- Constant initial margin: The future initial margin is assumed to be equal to today's initial margin.

Weighing the options

We estimated the one-year future initial margin for every month in a 10-year historical period for a hypothetical portfolio of foreign-exchange options and forwards on major currencies, giving us 120 historical data points for each method outlined above.8

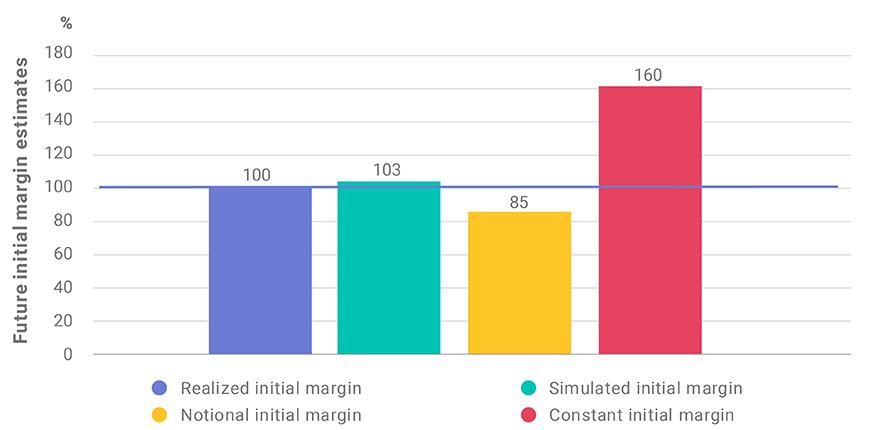

Performance of estimates of future initial margin

The mean of monthly future initial margin estimates of a portfolio of foreign-exchange derivatives, between 2009 and 2019, using a one-year simulation horizon. Our VaR-based forecast (simulated initial margin) compared well to the realized initial margin, unlike simpler solutions, such as initial margin calculated at analysis date and kept constant (constant initial margin) or scaled back based on notional amounts as positions mature (notional initial margin).

The above exhibit compares the average "realized" spot initial margin to the various approximations. The simulated initial margin captures future initial margin with a difference of only 3% against the benchmark. The constant initial margin leads to an overestimation by 60%, as the decrease of the required initial margin due to the maturing of positions is not captured.9 The notional initial margin takes expiry into consideration, but fails to account for the varying risk levels and underestimates the initial margin in our example by 15%. Overestimation would also be possible if the positions that matured before the simulation horizon were less risky than the remaining ones.

The effect of future initial margin on risk and valuation

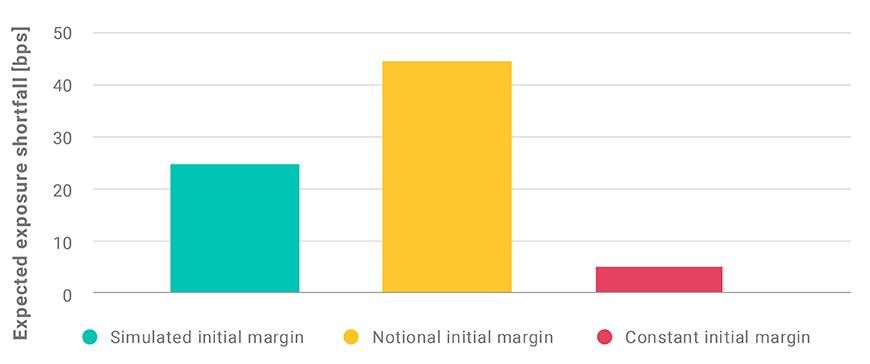

Although it is widely believed that the new rules would effectively eliminate counterparty credit risk, the received initial margin might not be enough to cover the exposure in extreme market scenarios.10 The exhibit below quantifies that risk and demonstrates that, for the hypothetical portfolio discussed above, the average expected exposure shortfall was 80% lower for the constant initial margin as compared to the simulated initial margin.11 The initial margin based on notional scaling led to a difference of similar magnitude in the opposite direction. In other words, depending on the method you may get vastly different risk estimates.

Risk estimates depended on the chosen approach

The average expected exposure shortfalls, in basis points of the total notional amount, with different estimates of received future initial margin, between 2009 and 2019, using a one-year simulation horizon.

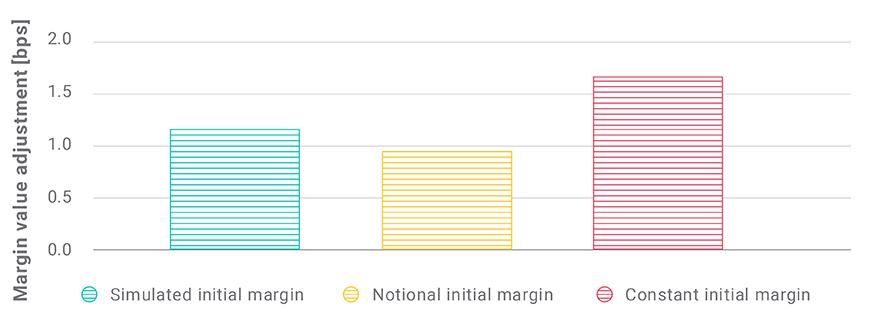

While the initial margin has key importance in counterparty risk, it also affects the fair value of the underlying derivatives transactions, since parties need to fund the collateral posted as initial margin.12 The exhibit below shows how a loosely calculated initial margin resulted in margin-value adjustments that did not reflect how various initial-margin models gave rise to contrasting margin-value adjustments. Compared to the simulated initial margin, the notional initial margin resulted in a 20% lower valuation adjustment, while the constant initial margin led to a 45% higher valuation adjustment.

Different methods led to significant difference in funding cost

The average margin-value adjustments, in basis points of the total notional amount, based on different estimates of posted future initial margin between 2009 and 2019.

Although the above results depended on the portfolio in question, they indicate how a model for future initial margin may have affected the estimation of both counterparty risk and the fair price of a derivatives portfolio.

3 Initial margin is additional collateral collected from and posted to a counterparty to cover, in case of a default, the exposure arising from changes in the market value of a derivatives portfolio from the last successful collateral exchange until the closeout of the transactions.

4 The final phase would have brought more than 10 times as many firms into scope in 2020 as the first four did so far. The growing concerns around implementation led to an extension of the transition period by one phase and one year, until Sept. 1, 2021. See, for example: "50 billion: The new magic number for initial margin rules." Risk.net, Aug. 5, 2019.

5 "ISDA SIMM Methodology, version 2.2." International Swaps and Derivatives Association, July 25, 2019.

6 This is not an exhaustive list: we chose these models to analyze the impact of using approximations with different accuracy.

7 The initial margin at a future horizon is calculated as the 0.99 quantile of the distribution of potential portfolio value changes between the future horizon and 10 days later. We use a Monte Carlo simulation to generate future scenario paths.

8 The portfolio consists of eight arbitrarily chosen FX options and forwards. FX is one of the major asset classes of OTC derivatives, and the trades were selected to span a range of different maturities and risk levels. While this portfolio serves well to illustrate our concepts, actual results on other portfolios may differ.

9 This blog post may contain analysis of historical data, which may include hypothetical, backtested or simulated performance results. There are frequently material differences between backtested or simulated performance results and actual results subsequently achieved. The analysis and observations in this report are limited solely to the period of the relevant historical data, backtest or simulation. Past performance — whether actual, backtested or simulated — is no indication or guarantee of future performance. None of the information or analysis herein is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision or asset allocation and should not be relied on as such.

10 See, for example:

Andersen, L., Pykhtin, M., and Sokol, A. 2016. "Credit Exposure in the Presence of Initial Margin." SSRN.

Moran, L. and Wilkens, S. 2017. "Capturing Initial Margin in Counterparty Risk Calculations." Journal of Risk Management in Financial Institutions 10: 118-129. 11 Expected exposure shortfall is a good measure of extreme scenarios, as it is the average exposure beyond a certain confidence level. Note that we used a highly stressed historical period for scenario generation. 12 The price of a position equals the CCR-free price plus adjustments, which include margin-value adjustment.

Andersen, L., Pykhtin, M., and Sokol, A. 2016. "Credit Exposure in the Presence of Initial Margin." SSRN.

Moran, L. and Wilkens, S. 2017. "Capturing Initial Margin in Counterparty Risk Calculations." Journal of Risk Management in Financial Institutions 10: 118-129. 11 Expected exposure shortfall is a good measure of extreme scenarios, as it is the average exposure beyond a certain confidence level. Note that we used a highly stressed historical period for scenario generation. 12 The price of a position equals the CCR-free price plus adjustments, which include margin-value adjustment.

Further Reading

Subscribe todayto have insights delivered to your inbox.

1 Stafford, P. “Global regulators delay ‘big bang’ rule by a year.” , July 23, 2019.2“Margin requirements for non-centrally cleared derivatives.” Basel Committee on Banking Supervision and International Organization of Securities Commissions, July 23, 2019.

The content of this page is for informational purposes only and is intended for institutional professionals with the analytical resources and tools necessary to interpret any performance information. Nothing herein is intended to recommend any product, tool or service. For all references to laws, rules or regulations, please note that the information is provided “as is” and does not constitute legal advice or any binding interpretation. Any approach to comply with regulatory or policy initiatives should be discussed with your own legal counsel and/or the relevant competent authority, as needed.