Extended Viewer

Tariffs Expose a Rift in the Clean-Tech Supply Chain

China’s export controls on rare earths in response to U.S. tariffs revealed vulnerabilities in the global critical-mineral supply chain, which underpins many advanced technologies, including clean-tech solutions. Export controls are not an outright embargo, but exporters must apply for licenses to sell rare earths outside China, which can affect all markets. If export controls are tightened further, clean-tech providers outside China may experience stagnant growth.1

A pause on tariffs, not on risks

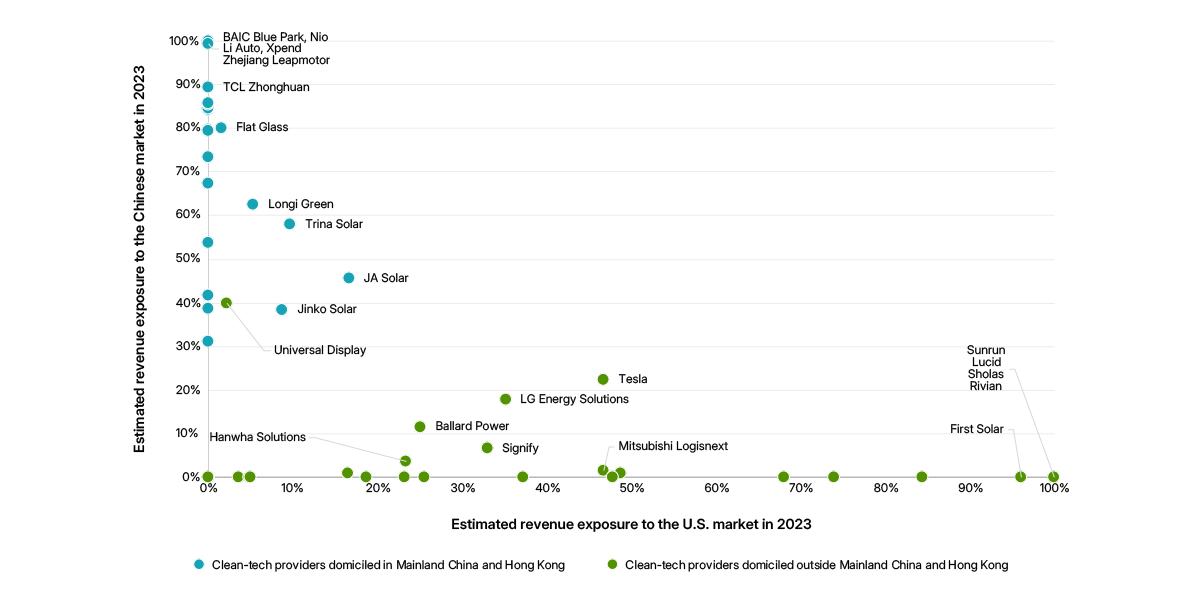

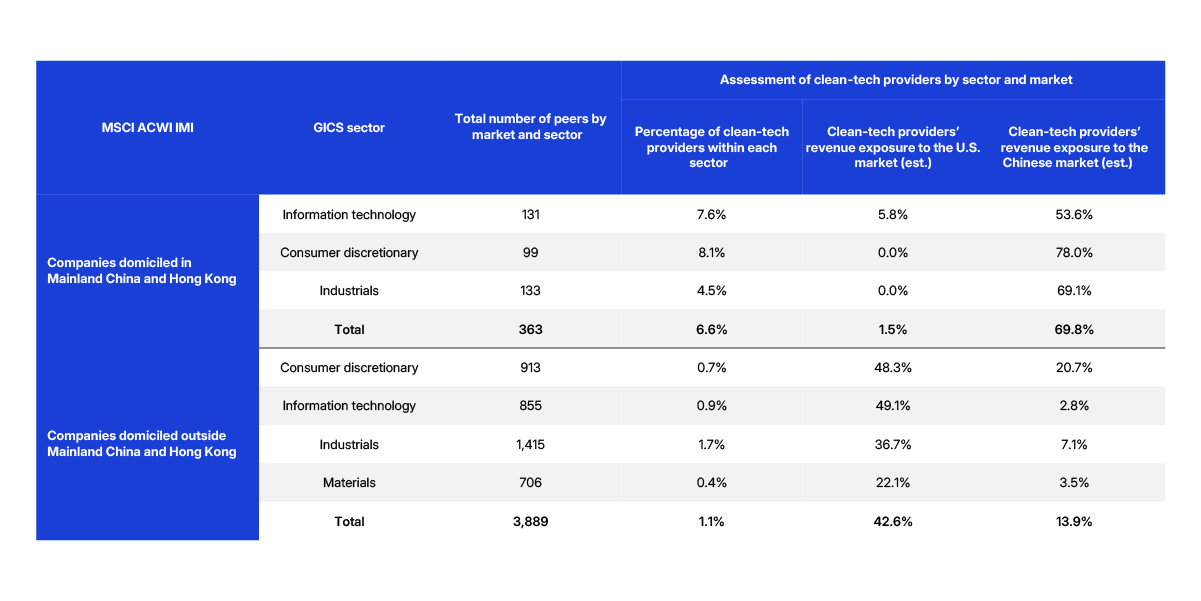

Although the U.S. and China agreed to a 90-day pause on reciprocal tariffs and eased the immediate tensions around export controls for rare earths,2 other tariffs remain in place and could continue to weigh on sales growth. As the chart illustrates, Chinese solar-panel makers such as JA Solar Holdings Co., Trina Solar Co. Ltd., JinkoSolar Holding Co. and LONGi Green Energy Technology Co. Ltd. derived sizable revenues from the U.S., where the impact of tariffs will be most felt. Meanwhile, most Chinese clean-tech providers in the MSCI ACWI Investable Market Index (IMI) generated more than half of their sales within the domestic market, as the table shows.

Lack of access to critical minerals may also spur the development of new technologies.3 Japanese carmakers have designed new vehicles that reduced reliance on rare earths in response to China’s rare-earths export restrictions to Japan in 2010.4 And, while still in the nascent stage, the making of perovskite solar cells is reliant on iodine rather than rare earths.5

The ongoing trade war will likely play a key role — whether by accelerating the diversification of critical mineral sources,6 spurring innovation in clean technologies, reinforcing China’s dominance in the global critical-mineral supply chain or potentially through all these factors. Companies positioned to adapt to supply-chain disruptions or capitalize on emerging alternative technologies may offer significant opportunities for investors, or elevated risks depending on their exposure.

The US-China split among top clean-tech providers

US-China clean-tech revenue insights by sector

1 “China has a weapon that could hurt America: rare-earth exports,” The Economist, April 10, 2025.

2 “China Loosens Grip on Magnet Exports, Relieving Carmakers,” Wall Street Journal, May 16, 2025.

3 “China has a weapon that could hurt America: rare-earth exports,” The Economist, April 10, 2025.

4 “Honda’s Heavy Rare Earth-Free Hybrid Motors Sidestep China,” Bloomberg, July 12, 2016.

5 “The resource demands of multi-terawatt-scale perovskite tandem photovoltaics,” Science Direct, April 27, 2024.

6 “Ukraine, US sign minerals deal sought by Trump,” Reuters, May 2, 2025.

Related content

Aerospace, Defense and Tariff Turbulence

Tariffs and tangled supply chains: This week, we explore how commercial aerospace and defense companies are navigating a new wave of trade restrictions. From Boeing to Lockheed Martin, what do transparency and oversight mean when the stakes — and the sky —are high?

Listen to the episodeThe Physical Risks of Reshoring

From car factories to aluminum smelters to textiles, the purported goal of the Trump administration is to 'reshore' American manufacturing. It’s a goal, in part, supported by his predecessor, Joe Biden, who enacted the CHIPS act to bring semiconductor manufacturing back to America. So, let's say manufacturing does come back and companies expand their current factories to meet demand. What climate-driven risks—water shortages, extreme heat, or flooding—will these sites face, and where will those hazards hit hardest? We’ll explore the answers on this episode of Sustainability Now!

Learn moreMapped or Missed? Navigating Tariff Uncertainty

Traceable supply chains can offer clarity amid trade-policy volatility, aiding businesses in forecasting costs, navigating tariffs and reducing investor risk.

Read the quick take