Breadcrumb

ESG Fund Metrics hero image

MSCI ESG Fund Ratings

Introducing MSCI ESG Fund Ratings

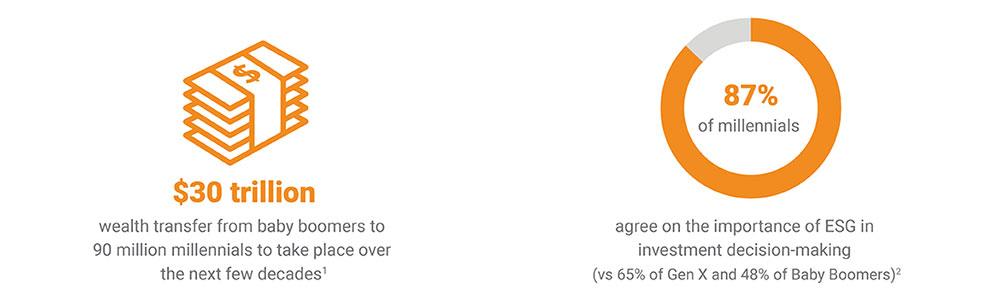

There is growing demand among wealth and asset managers for greater investment transparency driven by a desire to better reflect their investment views and values.

In response to this growing trend for greater transparency, MSCI ESG Research provides the tools to gain insight into the ESG characteristics of funds with an intuitive rating to better inform clients’ efforts across fund research, product selection, portfolio construction, and portfolio reporting across asset classes.

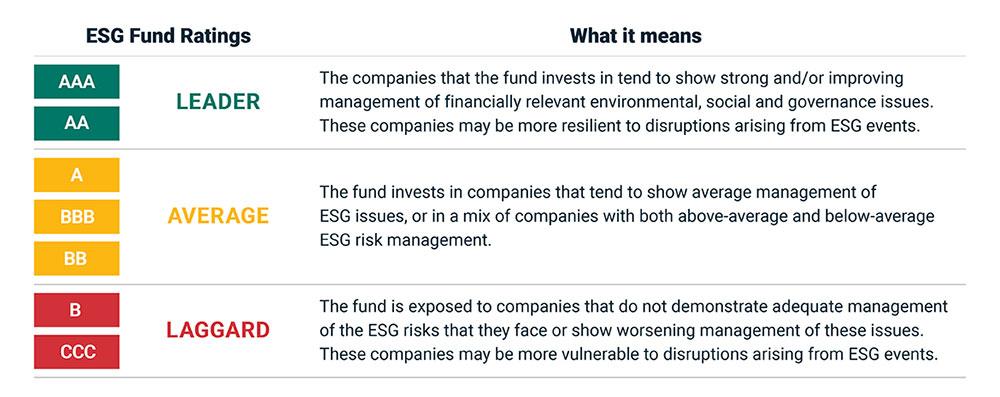

MSCI ESG Fund Ratings measures the Environmental, Social and Governance (ESG) characteristics of portfolio holdings and provides clients with the ability to rank or screen over 32,000 mutual funds and ETFs on a AAA to CCC ratings scale.

Clients will also have access to over 200 Fund Metrics to evaluate the ESG attributes of their portfolio and fall into three categories: sustainable impact, values alignment and risks.

MSCI ESG Fund Ratings are available directly from MSCI ESG Research and on third-party platforms.

For further information

- Download the factsheet

- Download the Executive Summary methodology

- Contact us for more information about your MSCI ESG Fund Rating esgclientservice@msci.com

MSCI unveils ESG rating for 32,000 funds and ETFs to boost investor transparency

MSCI unveils ESG rating for 32,000 funds and ETFs to boost investor transparency

The MSCI ESG Fund Ratings responds to the demands of investors for greater transparency to understand the ESG characteristics of their portfolios.

Under the hood: Rating ESG Funds

Under the hood: Rating ESG Funds

ESG investing is growing quickly but do ESG funds practice what they preach?

MSCI ESG Fund Metrics launches on leading market data platforms

MSCI ESG Fund Metrics launches on leading market data platforms

In October 2016, we introduced over 100 metrics including the MCSI ESG Fund Quality Score. Learn more about the market data platforms that have integrated these metrics.

Interested in Sustainable Investing?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.