2019 Real Estate Snapshot hero banner

2019-2020

2019 Real estate snapshot

Organized by theme, this edition of the MSCI Real Estate Research Snapshot tracks the emerging trends impacting our industry. These trends - transparency, ESG and geopolitical risk, endurance of cycles and disruptive technological change - have been the focus of our CEO roundtables and broader client conversations this year, and no doubt the talk of investment boards the world over.

MSCI Real Estate is a long-time champion of transparency. So we start by exploring the challenges and opportunities of a broadening real estate asset class and the importance of a coherent benchmarking framework to be clear on your performance drag and drivers. We then examine risk on three fronts: geopolitical risk, technological driven disruption, and private real estate portfolios’ exposure to climate change. This past year saw industrial boom continue, retail slides and global asset-level real estate delivering a total return of 7.4% last year, slightly down on the year before. So, in the final chapter we zoom out and look at big picture late cycle investing, global property performance and market size.

At MSCI Real Estate we uncover the data behind the headlines to provide the actionable insights that help you to keep pace with industry change and make better investment decisions -- wherever you sit in the investment process.

Will Robson

Executive Director, Global Head of Real Estate Solutions Research, MSCI

download the research snapshot CTA

Research snapshot 2019 tab selector

Age of

Transparency

Age of

Transparency

ESGTechnology

Driven DisruptionGeopolitical Risk

Endurance

of Cycle

Exploring the ‘what ifs?’ in real estate

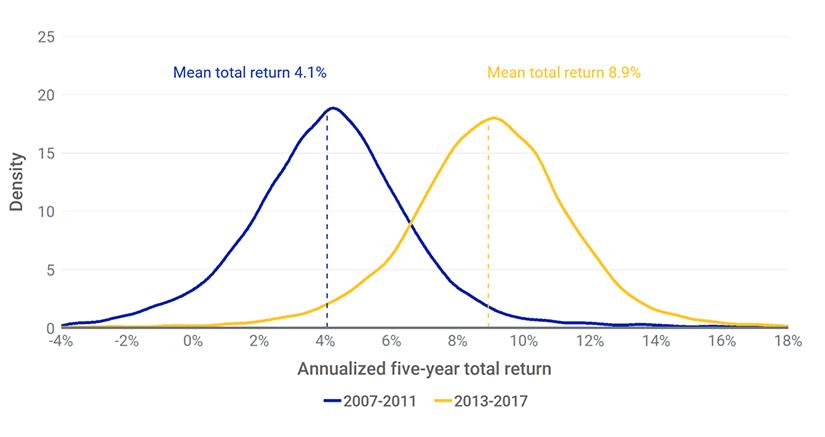

The opacity of real estate markets and the wide spectrum of potential outcomes makes it hard to understand performance. Running a historical “what if” analysis may help institutional investors understand how different choices could have impacted outcomes.

| "What-if analysis |

| may help investors |

| get a better sense of |

| how their performace |

| measured up against |

| the range of possible |

| outcomes" |

Featured research:

Benchmarking in real estate: Beyond performance measurement

Changing face of real estate portfolios

Climate risk in private real estate portfolios: what’s the exposure?

This research looks asset by asset to see which properties within institutional investment portfolios were exposed to climate risk and to identify specific concentrations of risk.

"84% |

| of capital value at risk |

| from BWS in Australia" |

Featured research:

Underwater assets? Real estate exposure to flood risk

Have appraisers been too bullish on real estate?

Media commentary has fixated on the shuttering of shops, while retail-focused REITs are priced at substantial discounts to the value of their assets. Have appraisers of retail real estate been excessively bullish?

| "The question |

| of value is not as |

| straightforward |

| as it first appears" |

Featured research:

Asian retail resilience: have store hours affected performance?

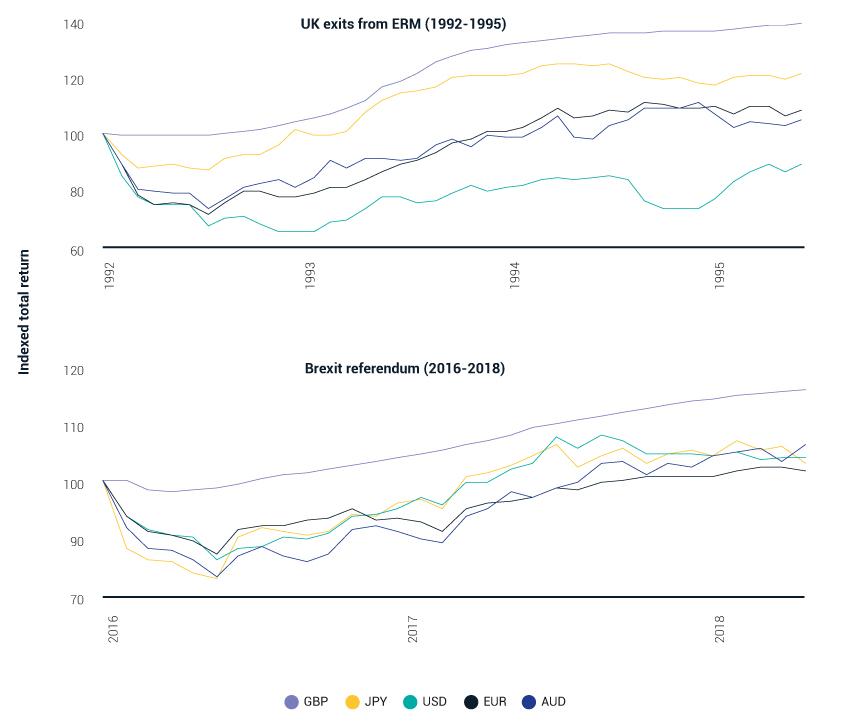

Brexit, Black Wednesday and real estate currency risk

When investors buy overseas real estate, they inevitably take on foreign-exchange exposure. The resulting currency-market dislocations resulted in near-term losses for some investors, but also created attractive opportunities for investors to buy real estate exposure in the U.K.

| "Currency risk led |

| to opportunities |

| during the Brexit |

| referendum and |

| Black Wednesday" |

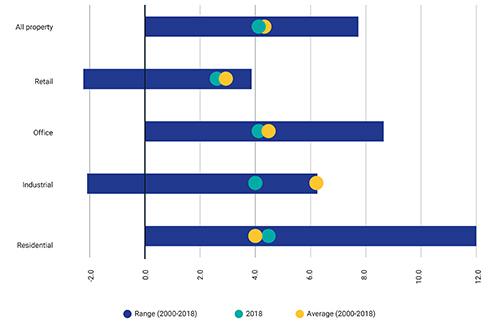

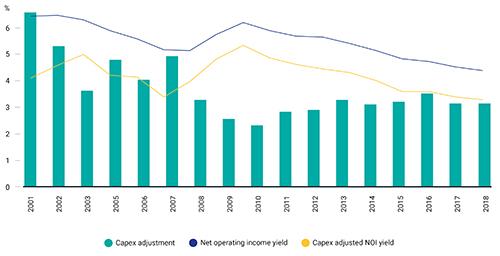

Real estate may be yielding less than you thought

Income has long been an important part of real estate returns meaning yields are often heavily scrutinized by investors. However, headline yields do not factor in capital expenditure requirements which can vary significantly. Investors looking to better understand potential “free cash flow” positions of portfolios post-capex may want to adjust the yields they use to account for it

"4.4% |

vs |

3.3% |

| NOI yield vs capex adjusted |

| yield for MSCI Global Annual |

| Property Index in 2018" |

Featured research:

Don’t confuse capital growth and asset-value growth

Measuring real estate capital growth isn’t rocket science, is it?

Global real estate performance

Market size

Download the Full Report CTA

Callout cards

Benchmarking: Beyond Performance Measurement

Changing Face of Real Estate Portfolios