QuickSearch

Featured content

Featured content

Dynamic content cards

Our latest research

Understanding Sector-Specific Sustainability Risks in Australia’s Equity Market

May 16, 2025 Drashti Shah, Manish Shakdwipee, Kuldeep YadavAustralian companies managing sector-specific sustainability risks effectively experienced improved equity-market performance, highlighting the value of tailored sustainability strategies in investment processes.

How Climate-Transition Risks May Impact Lending Practices

Mar 10, 2025 Anja Ludzuweit, Guilherme de Melo SilvaClimate-transition risks are reshaping lending and investment activities. Find out how banks can navigate these challenges with scenario-based risk-management strategies to meet new regulatory expectations.

Which Sustainability Issues Mattered Most?

Feb 24, 2025 Liz Houston, Guido Giese, Xinxin Wang, Zoltán NagySustainability data can signal stock-market torpedoes — or long-term winners. Our research reveals the key environmental, social and governance indicators that helped investors avoid sharp drawdowns and capture outperformance.

Carbon-Footprint Attribution for Total Portfolio

Feb 19, 2025A portfolio’s carbon footprint can shift for many reasons — corporate action, market forces or portfolio rebalancing. Our new unified framework breaks down carbon-footprint attribution across asset classes to help investors pinpoint the key drivers.

Understanding Carbon Markets

Dec 11, 2024A comprehensive guide to the essentials of carbon markets, including compliance and voluntary markets, how companies and investors use carbon credits, and carbon-credit quality.

Sustainable-Finance Regulation — a Look Ahead for 2025

Dec 3, 2024 Simone Ruiz-Vergote2025 could mark a turning point for sustainable finance, with the EU’s CSRD and global ISSB standards driving transparency. Financial institutions will need to navigate evolving frameworks, balancing compliance challenges with sustainability opportunities.

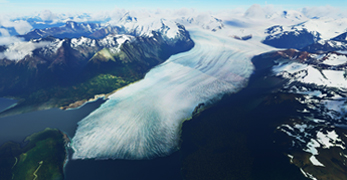

Baku to the Future: What COP29 Means for Investors

Nov 26, 2024 Guy Turner, Linda-Eling Lee, Oliver MarchandCOP29 advanced international carbon trading with key agreements. Mixed signals on the energy transition, however, affirm investors’ view of an uneven transformation, while investment to address climate-driven physical risk looks likely to continue apace.

Funds and the European Sustainable Finance Landscape 2024

Oct 28, 2024We evaluate European funds’ performance under sustainability regulations, including SFDR article 8 and 9 funds, EU Taxonomy alignment and new fund-naming guidelines, offering insights into regulatory developments and data improvements.

Legislation

MSCI ESG Research LLC. is a Registered Investment Adviser under the Investment Adviser Act of 1940. The most recent SEC Form ADV filing, including Form ADV Part 2A, is available on the U.S. SEC’s website at www.adviserinfo.sec.gov.

MIFID2/MIFIR notice: MSCI ESG Research LLC does not distribute or act as an intermediary for financial instruments or structured deposits, nor does it deal on its own account, provide execution services for others or manage client accounts. No MSCI ESG Research product or service supports, promotes or is intended to support or promote any such activity. MSCI ESG Research is an independent provider of ESG data, reports and ratings based on published methodologies and available to clients on a subscription basis.

Foundations of ESG Investing

Foundations of ESG Investing

How ESG integration has affected benchmarks and index-based, factor and active portfolios.

ESG Fund Ratings

ESG Fund Ratings

MSCI ESG Fund Ratings aim to measure the resilience of mutual funds and ETFs to long term risks and opportunities arising from environmental, social and governance (ESG) issues.

ESG Now

ESG Now

The latest ESG news and research, from climate change to corporate action, in this weekly podcast.

Interested in our Research?

Get the latest trends and insights straight to your inbox.

Select your topics and use cases to stay current with our award winning research, industry events, and latest products.