面包屑导航

导航菜单

- MSCI ESG Focus Indexes

- Currency Hedged

-

Market Cap Weighted

- MSCI全市场指数

- MSCI China A Inclusion Indexes

- MSCI China All Shares Indexes

- MSCI China A International Indexes

- MSCI ASEAN Indexes

- MSCI Emerging Markets ex China Index

- MSCI US Equity Indexes

- MSCI Indexes for Canadian Investors

- MSCI Saudi Arabia Indexes

- MSCI US REIT Custom Capped Index

- MSCI Indexes for Australian Investors

- MSCI USA IMI Sector Indexes

- MSCI可投资市场指数

- MSCI新兴市场和前沿市场指数

-

Factors

- MSCI Single Factor ESG Reduced Carbon Target Indexes

- MSCI Factor Mix A-Series Indexes

- MSCI Diversified Multiple-Factor Indexes

- MSCI股息

- Índice MSCI All Colombia Local Listed Risk Weighted

- MSCI High Dividend Yield

- MSCI因子指数

- MSCI Equal Weighted Indexes

- MSCI Select Value Momentum Blend Indexes

- MSCI质量和高红利指数

- MSCI Top 50 Dividend Indexes

- MSCI最小波动率指数

- MSCI Growth Target Indexes

- MSCI风险加权指数

- Índices MSCI Mexico Select Momentum Capped & Mexico Select Risk Weighted

- Additional Index Profiles

INDEX OVERVIEW

MSCI U.S. equity indexes

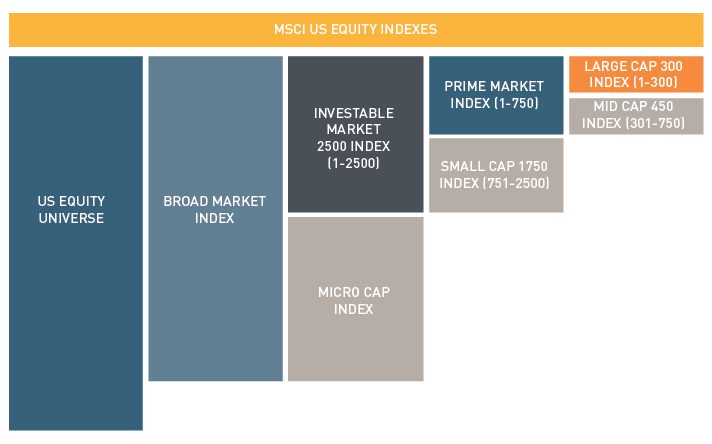

The MSCI US Equity Indexes are a domestic only series - independent from MSCI’s Global Equity indexes – which reflect the investment opportunities in the US equity markets by market capitalization size, by value and growth investment styles and by sectors and industries.

PERFORMANCE, FACTSHEETS AND METHODOLOGIES

MSCI U.S. Equity Indexes Methodology

MSCI U.S. Equity Index Total Return

MSCI U.S. Broad Market Index

Captures broad U.S. equity coverage representing about 99% of the U.S. equity universe.

Performance | Factsheet

MSCI U.S. Investable Market 2500 Index

Designed to measure the performance of the small-, mid-, large- cap segment of the U.S. equity market. It is the aggregation of the MSCI U.S. Prime Market 750 (that is, the Large Cap 300 and Mid Cap 450 indexes combined) and Small Cap 1750 indexes.

Performance | Factsheet

The MSCI U.S. Micro Cap Index

Designed to measure the performance of the micro cap segment of the U.S. equity market.

Performance | Factsheet

MSCI U.S. Prime Market 750 Index

Represents the aggregation of the Large Cap 300 and the Mid Cap 450 Indexes.

Performance | Factsheet

MSCI U.S. Small Cap 1750 Index

Includes the remaining smallest 1,750 companies in the U.S.

Performance | Factsheet

MSCI U.S. Large Cap 300 Index

Is designed to measure the performance of the large cap segment of the U.S. equity market.

Performance | Factsheet

MSCI U.S. Mid Cap 450 Index

Includes the next largest 450 companies in terms of Market capitalization of the U.S. equity market and designed to measure the performance of the mid cap segment.

Performance | Factsheet

U.S. IMI Sectors 25/50

MSCI 25/50 Indexes Methodology

Methodology

MSCI U.S. IMI Consumer Discretionary 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Consumer Staples 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Energy 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Financial 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Health Care 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Industrials 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Information Technology 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Materials 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Real Estate 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Communication Services 25/50 Index

Performance | Factsheet

MSCI U.S. IMI Utilities 25/50 Index

Performance | Factsheet